Pitching VC's was not my favorite part of founding a SaaS. It's probably easier if you have the right network, but that wasn't me. Alternatives to VC are starting to spring up though. In just the last couple years, several revenue factoring companies have emerged to provide funding with a straight forward application process. This capital comes without equity or board seats.

This guide is designed to provide an in-depth comparison of the best revenue-based lenders in the market and help you select the right lender for your SaaS.

If you’re seeking non-dilutive funding for your company, try Paper. Paper allows SaaS founders to apply to dozens of capital providers with a single click.

Pipe

Founded in September 2019 by Henry Hurst, Josh Mangel, and Zain Allarakhia, Pipe’s mission is to provide SaaS companies with upfront revenue by matching them with investors who offer a discounted rate for the annual contract value. Pipe recently secured a round of funding that brings the company’s valuation to $2 billion in less than a year after its IPO.

As one of the top revenue-based lenders in the market today, Pipe’s trading platform helps SaaS organizations grow their business on their own terms. Clients can immediately turn their subscription revenue into upfront capital, allowing them to scale their organization rapidly without diluting their ownership.

Existing SaaS businesses that have established subscription revenue streams can be approved for a trading limit in minutes with revenue-based lenders. By signing up for an online account and connecting its existing systems to Pipe a SaaS can begin trading on Pipe within hours. Approved clients will have access to a portfolio of customer contracts ready to trade as well as real-time bids for the annualized value of these contracts from institutional investors. Essentially, an SaaS is “selling” a certain dollar amount of its monthly recurring revenue to receive a certain amount of cash to use immediately.

Pipe may offer a discount rate as low as 1% per month or 10% to 15% a year. Prospective clients can sign up for an account and apply with their particular company’s data to get an accurate bid price and rate from each investor.

Regardless of the size of a SaaS, capital can be accessed through revenue-based lenders such as Pipe as long as a recurring stream of revenue from customers exists on a monthly or quarterly basis. Signing up carries no risk: there’s no cost to join Pipe and no obligation to ever make a trade.

CapChase

CapChase was established in 2020 by Ignacio Moreno, Przemek Gotfryd, Luis Basagoiti, and Miguel Fernandez. Based in New York, this fintech business helps SaaS companies finance their business with cash that’s tied up in future monthly payments. Recently, CapChase closed a $125M Series A funding round led by QED Investors, providing a means to expand the funding the company can provide to its clients.

As one of the main revenue-based lenders, CapChase pays SaaS companies the annual value of their subscriptions today, allowing them to make needed investments to fuel future growth. The organization will potentially fund up to one year of future monthly recurring revenue. Similar to Pipe, CapChase starts its discount rate as low as 1% per month or 10% to 15% a year. CapChase offers a runway calculator on its website, which is a tool that helps a SaaS business determine how it can extend its runway to boost rapid growth without giving up equity. By entering the cash needed, annual recurring revenue, burn rate, annual topline growth, and the number of contracts as well as annual expenses growth rate, current discount, customer acquisition costs, sales cycle, an annual contract value, a SaaS can quickly optimize for runway, growth, or dilution. All data entries can be made anonymously, but contact information is required to receive results from revenue-based lenders such as CapChase.

Once a conversation with CapChase is opened, this organization may be willing to negotiate time frames and discounts that affect fees. In addition, rates can be adjusted depending on the SaaS’s future growth.

Founderpath

Established in 2019, Founderpath wanted to be an alternative way for bootstrapped SaaS start-ups to get capital without sacrificing equity. The founders of Founderpath have been bootstrappers themselves; the company is based in Austin, Texas, but operates remotely. In March 2021, Founderpath successfully raised $10 million, which allowed the company to finance additional SaaS customers and add key executives to its c-suite team.

By integrating with other financial companies such as Stripe and Quickbooks, this revenue-based lender can accurately analyze the strength of a SaaS applicant. Once accepted, customers can convert monthly recurring revenue into upfront cash. The application process can take under three days to secure financing. SaaS companies typically receive 11 months of upfront cash for monthly subscriptions, and costs are calculated using a SaaS credit score. Each Saas begins with a perfect score of 1,000, which gets reduced for each poor metric by this revenue-based lender.

Since Founderpath’s investors loan the company original funds at a set interest rate of 12%, SaaS founders will pay a higher rate for upfront cash. However, unlike venture capital, Founderpath has no personal guarantees and takes no equity. It also charges no origination or due diligence fees.

The company points out that many SaaS firms offer a 20% to 30% discount to customers for paying their monthly subscriptions upfront on an annual basis. Since Founderpath promises to convert the same fee to an upfront cost at 17% or less, customers can retain more of their revenue.

Stripe Capital

Stripe Capital provides customers with rapid and flexible financing options in a non-dilutive manner. U.S. SaaS companies using Stripe’s payment platform must have at least one year’s worth of payment history and will typically receive three loan offers at one time. Customers may choose a custom loan amount up to the maximum offered. Although offers expire, new offers based on transaction history are constantly being generated by this revenue-based lender.

If a SaaS chooses to access upfront cash, Stripe will automatically collect a percentage of future subscription payments. Although a minimum payment is required every 60 days, in general, this repayment method allows a SaaS company to pay down more of its loan during busier times and less in slower periods. Stripe charges a flat fee for the loan and no ongoing interest. The minimum payment will ensure the loan is paid off within 18 months.

Once an offer is accepted, this revenue-based lender makes the funds available in your account within one to two business days. For example, a company with monthly recurring revenue of $27,000 may be able to borrow up to $100,000, which can be paid back over 12 months.

Honorable Mentions

The following revenue-based lenders have been selected as “honorable mentions” in our comparison, also providing capital to SaaS companies without requiring equity and control.

ARR Squared

Based in Singapore with offices in Australia and the United States, ARR Squared provides access to non-dilutive capital by converting monthly subscriptions to upfront cash. Founded by Preet Gona and Alexis Zirah, ARR Squared works to provide an alternative means of capital to extend a SaaS company’s runway and booth growth and revenue potential without sacrificing equity.

As one of the leading revenue-based lenders, the company begins its lending process by running data from the applying SaaS through its analytics arm. By synchronizing accounting information and subscription management with the ARR Squared system, the company can generate a discount rate to an annual contract value within a few minutes.

RevTek Capital

Headquartered in Forest Grove, Oregon, RevTek was founded in 2000 by entrepreneurs. The founders' goals revolved around helping fellow entrepreneurs hold onto their equity as they grew by providing growth capital in the form of debt. In addition to capital, RevTek’s professionals can assist with operations, marketing, and finance.

In order to qualify, a SaaS must have a predictable recurring revenue of at least $50,000 per month with a minimum gross margin of 50%. However, profitability is not required. Typically, such clients can borrow up to one-third of their annualized revenue run rate or 40% of their annual recurring revenue.

Decathlon Capital Partners

Unlike the previously discussed revenue-based lenders, Decathlon Capital Partners is not sector-specific. Although the company can provide revenue-based capital to SaaS businesses, it also finances a wide variety of other companies in multiple industries.

Based in Salt Lake City and San Francisco, Decathlon was founded in 2010 ”to democratize access to growth-stage capital.” The lender believes that equity-based funding models have a conflict of interest with the businesses they finance.

SaaS firms seeking capital to grow their customer base, develop their offerings, or expand their team can secure capital and repay the loan as revenue allows. Since a typical funding package requires loan repayment over two to five years, SaaS companies can expand without restrictive or short-term constraints.

Terms

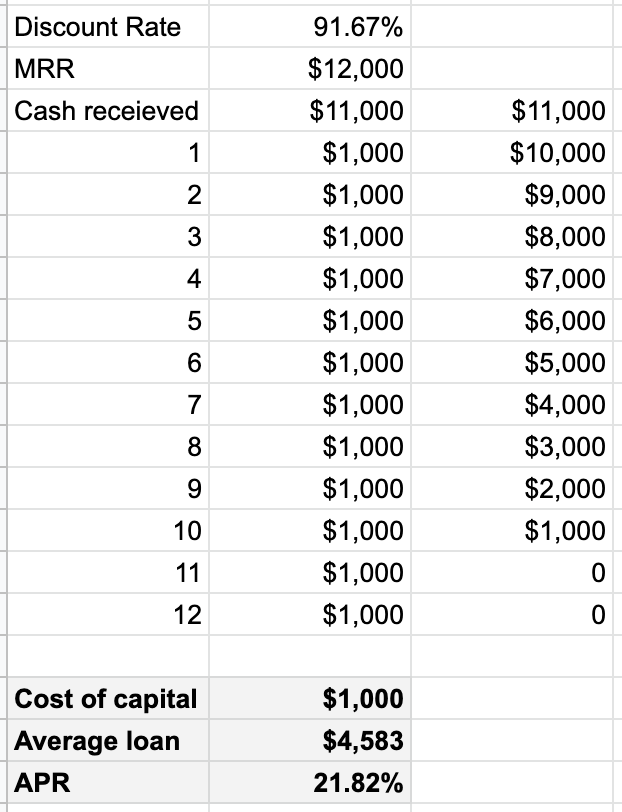

For VC funding, the cost of capital is really tough to calculate (e.g. what's 5% of your company going to be worth in 5 years?). It's much simpler with factoring, but there's one part of the math I missed at first.

For example, if a SaaS agrees to accept a $10,000 loan at the beginning of a calendar year to be paid back from monthly revenue of $1,000 per month over the course of a year, it can appear that the “interest rate” is only 20%. However, this assumes the loan is completely paid back at the end of the calendar year, not throughout.

The reality is that a $10,000 loan taken on January 1 of a calendar year is repaid with $1,000 monthly installments at the end of each month. This means the lender actually recoups funds throughout the year with the initial investment amount returned in only 10 months. This results in an actual interest rate of 41.5% because the average amount you borrowed over the year is closer to $4,000 and you "paid" $2,000 to borrow it.

If this same $10,000 loan is taken on January 31 of a calendar year, with $1,000 monthly installments paid back at the end of each month, the actual interest rate skyrockets to 51.4%. Here's another example with where you give $1,000 in MRR for $11,000 now:

Check out Paper

Paper is a capital marketplace for SaaS companies. We allow SaaS organizations to apply to dozens of capital providers with a single click. The process is easy:

- Connect to your payment provider (e.g. Stripe)

- Select acceptable loan parameters (e.g. duration, interest rate) and desired loan amount

- Get matched with multiple lenders in an instant